As an accompaniment to our biweekly series on “What Every Multinational Should Know About” various international trade, enforcement, and compliance topics, we are introducing a second series of quick-hit pieces on compliance best practices. Give us two minutes, and we will give you five suggested compliance best practices that will benefit your international regulatory compliance…

The adopted revision to the 2011 single-permit directive has been published in the Official Journal of the European Union, and the EU Council has temporarily suspended certain elements of EU law that regulate visa issuance to Ethiopian nationals.

Key Points:

The single-permit directive enters into force on May 21, 2024, and EU member states have until May 21, 2026, to implement…

What Happened:

On April 24, 2024, President Biden signed into law the Fentanyl Eradication and Narcotics Deterrence (FEND) Off Fentanyl Act, as part of a national security legislative package, which, among other things, amended the International Emergency Economic Powers Act (IEEPA) and the Trading with the Enemy Act (TWEA) to extend the statute of limitations for…

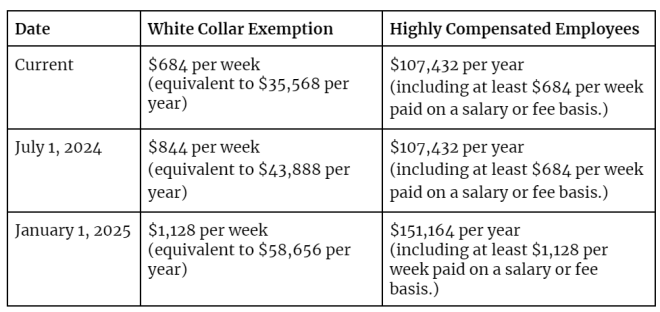

Changes to overtime rules under the Fair Labor Standards Act (FLSA) announced on April 23, 2023 affect most U.S. employers. The Final Rule substantially increases the number of employees eligible for overtime pay. It is critical that employers understand the rule and its implications for their business.

Current FLSA Overtime Regulations: The Basics

The FLSA requires employers…

On April 29, 2024, the U.S. Equal Employment Opportunity Commission (EEOC) issued the final version of new workplace harassment guidance for employers, formally updating the EEOC’s position on the legal standards and employer liability under federal antidiscrimination laws for the first time in more than two decades.

Quick Hits

The EEOC issued a final version…

Normally, the path most traveled is thought to be the better road as it represents the path that leads to achieving goals and success while the less traveled path leads to stressful processes and unknowns.

But for firms trying to achieve CRM success, the “beaten path” involves investing tens of thousands of dollars into the…

What are the tax accounting rules for hedges?

Whether or not a qualified tax hedge is properly identified, it must be tax accounted for under a method that clearly reflects income.[1] The timing of gains and losses on hedges must match the timing of income and loss reporting on the hedged items. Aggregate tax hedgers…

Over the past few decades, modern whistleblower award programs have radically altered the ability of numerous U.S. agencies to crack down on white-collar crime. This year, the Department of Justice (DOJ) may be joining their ranks, if it incorporates the key elements of successful whistleblower programs into the program it is developing.

On March 7,…

A paradigm shift in legal practice is occurring now. The integration of artificial intelligence (AI) has emerged as a transformative force, particularly in civil litigation. No longer is AI the stuff of science fiction – it’s a real tangible power that is reshaping the manner in which the world functions and, along with it, the…

In May 2023, the Centers for Medicare and Medicaid Services (“CMS”) proposed a series of rule changes intended to help promote the availability of home and community-based services (“HCBS”) for Medicaid beneficiaries. Chief among these proposals was a new rule that would require HCBS agencies to spend at least 80% of their Medicaid payments for homemaker,…